FOREX TRADING TERMINOLOGIES

Here is a list of basic terms you will often hear within the FX trading industry:

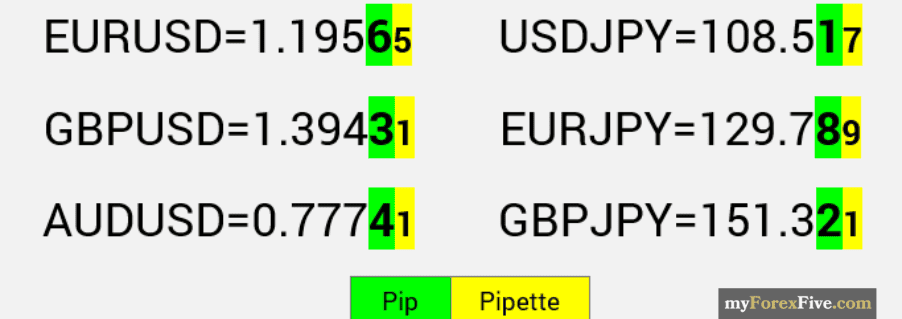

PIP is an acronym for percentage in point or price interest point. It represents the change in value between two currencies. A pip it is the 4th decimal place in the currency pair. For JPY pairs, a pip is on the 2nd decimal place of the Forex pair, so the second digit after the decimal point is the pip.

PIPETTE Are fractional pips. It is 1/10 of a pip, usually calculated using the 5th decimal number (For JPY pairs, it is calculated using the 3rd decimal).

BID AND ASK PRICE

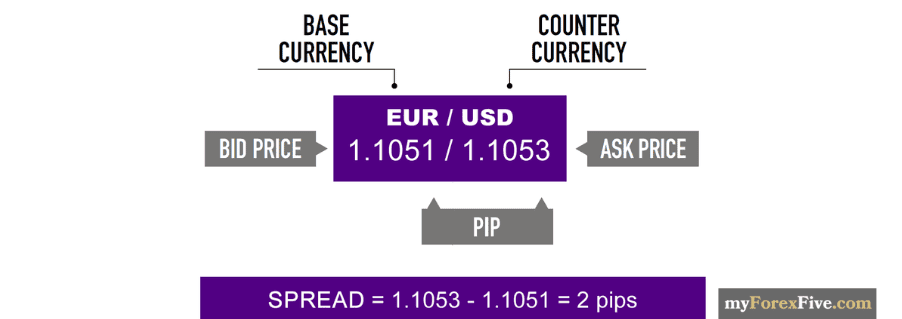

Bid - The price at which the market maker/broker is willing to buy the base currency in exchange for the counter currency. The value of the underlying currency pair affects the Bid price.

Ask - The price at which the market maker/broker is willing to sell the base currency in exchange for the counter currency. It is also based on the value of the underlying currency pair.

Here is a brief explanation

Ask price: Is the price at which you can BUY the base currency.

Bid price: Is the price at which you can SELL the base currency

Spread: The difference between the ASK and BID price.

Leverage Is the ratio applied to the margin amount to establish how big a trade is going to be placed. Leverage is a way for traders to borrow capital to gain a larger exposure to the FX market. With a limited amount of capital, they can control a larger trade size. This could lead to bigger profits and losses as they are based on the full value of the position.

Leverage is written into ratio starting from 1:1, 1:50, 1:1000 it depends broker to broker, some broker offers maximum leverage up to 1:500 other offer up to 1:2000 so you choose the leverage according to you are needs. Choose the leverage wisely to reduce the risk, the more the leverage more risk

NOTE; Actual required margin would change based on currency pair

| LEVAREGE | AMOUT TRADED | REQUIRED MARGIN (CAPITAL) |

| 1:1 | 100,000 | $100,000 |

| 1:2 | 100,000 | $50,000 |

| 1:50 | 100,000 | $2,000 |

| 1:100 | 100,000 | $1,000 |

| 1:200 | 100,000 | $500 |

| 1:400 | 100,000 | $250 |

LOT SIZE A lot in forex trading is a standardized unit of measurement used to describe the volume or size of a particular trade. A lot represents the amount of a currency bought or sold in a trade. Foreign exchange traders tend to offer different lot sizes that can be used to enter the market.

Important to understand lot size in forex:

Account management. Forex brokers typically require a minimum deposit to open an account, and the lot sizes available may vary depending on the account type. Understanding lot sizes could help traders determine which account type is best suited to their trading style and account size.

Trading strategies. Different trading strategies may require different lot sizes. For example, a day trading strategy that involves opening and closing trades within one day may consider smaller lot sizes, while a long-term strategy may involve larger lot sizes. Understanding lot sizes could help traders choose a lot size that aligns with their trading strategy.

TYPES OF LOT SIZE

| LOTSIZE | UNIT | VOLUME/LOT | PROFIT IN $ PER ONE PIP |

| STANDARD | 100,000 | 1 | $10.00 |

| MIN LOT | 10,000 | 0.1 | $1.00 |

| MICRO LOT | 1,000 | 0.01 | $0.10 |

| NANO LOT | 100 | 0.001 | $0.01 |

What is Margin? is the amount of money that a trader needs to put forward in order to place a trade and maintain the position. Margin is not a transaction cost, but rather a security deposit that the broker holds while a forex trade is open

Margin Call is a notification which lets you know that you need to deposit more money in your trading account, or close losing positions, in order to free up more margin. It's denoted as a fixed percentage which is determined by your broker and can be seen in the Account Specifications of your trading account.

SHORT AND LONG You’ve probably heard about going long or short in a currency pair. SHORT Means SELL and LONG means BUY

Traders will go Long when they expect that the price of the currency pair will rise and they go short when they expect that the price will fall.

BEAR/BEARISH MARKET A bear is a trader who believes that prices will fall or sell and bearish market is when the price is in a downtrend, marked by lower highs and lower lows.

BULL/BULLISH MARKET A bull refers to an investor/trader who believes that the price of a market will rise or buy and Bullish market is when the price is in uptrend momentum market by higher highs and higher lows.

SWAP Is the interest that you pay for a trade that you held overnight in forex market.

There are two types of swaps

Swap long interest charges for keeping long positions open overnight and Swap short interest charges for keeping short positions open overnight

POSITION means single opened trade.

What is difference between trade and position?

If you only have one trade open, position and trade are the same. However, if you have various trades open simultaneously, a position will be made up by the combination of all these trades.

MARKET ORDER is an order to buy or sell a currency pair at the market's best available price through broker’s trading platform.

STOP LOSS ORDER - A market order used to close a losing position once it has reached a certain level.

CLOSE AT PROFIT ORDER( Take Profit) - A market order used to close a profitable position once it reaches a certain level.

META TRADER 4 (MT4) Is a platform for Forex traders to trade a wide range of assets. It is the gateway between you and the trading markets. it gives traders the ability to conduct a wide range of trading activities, including charting and technical analysis, monitoring the markets, and automating trades through Expert Advisors.

The MT4 can be downloaded for free and provides an effective tool for trading forex, futures markets and CFDs online, both from a PC as well as from tablets and smartphones.