FOREX MARKET TREND

Refers to the general direction of an asset price overtime.

Investors everywhere are always on the lookout about where the market is heading. Market trends help them make smart decision about buying and selling stocks, bonds and currencies.

TYPES OF MARKET TREND

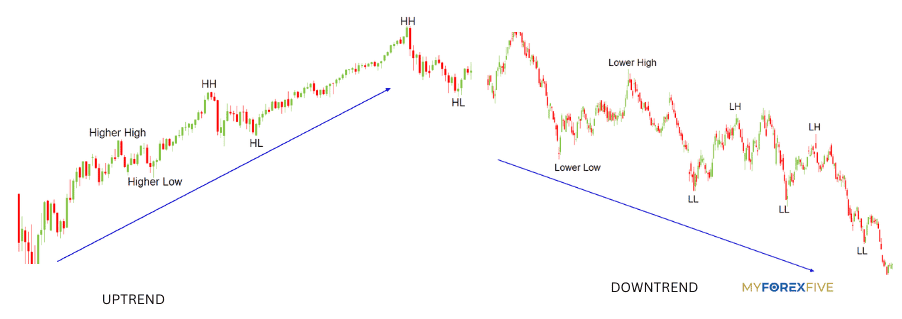

1.UPTREND: Occurs when the overall direction of the market or the price of an asset is rising over time. It is characterized by a series of higher highs and higher lows, indicating a general upward direction of price.

2. DOWNTREND: Occurs when the market or price of an asset is consistently decreasing. It is characterized by a series of lower highs and lower lows, indicating a general downward direction of price.

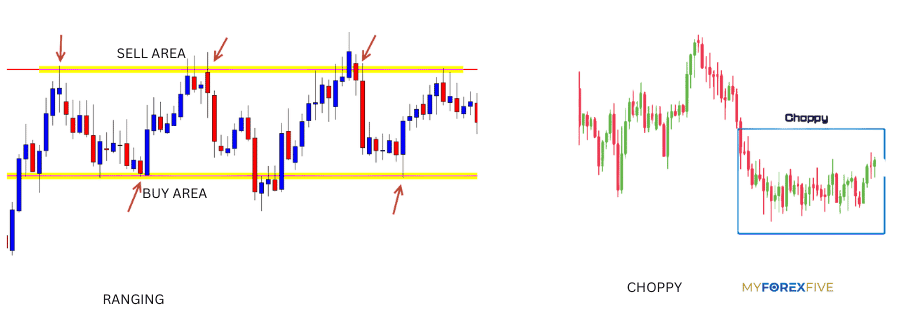

3. SIDEWAYS/RANGING: In this trend, the market or asset price moves within a relatively narrow range without a clear upward or downward direction.

4. CHOPPY MARKET: It is when an asset’s price shows no clear trend but instead experience many smaller fluctuations.

HOW TO IDENTIFY FOREX MARKET TREND

Moving Average

Use moving average to smooth out price data and identify the overall direction of the trend. Rising moving average indicate that the market is in upward trend while declining moving average indicate a downward trend.

Trendlines

Trendlines are sequence of straight lines connecting a sequence of price points. Draw trendlines connecting significant highs or lows on a price chart to visually identify the direction of the trend. An uptrend is characterized by higher highs and higher lows, while a downtrend has lower highs and lower lows.

Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the speed and change of price movements. Reading above 70 indicate overbought conditions and potential reversals in an uptrend, while readings below 30 suggest oversold conditions and potential reversal in a downtrend.

Price pattern

Recognize common chart pattern such as flags, pennants, and triangles, which can indicate the continuation or reversal of trends.

TREND TRADING STRATEGY

Trend trading strategies aim to capitalize on the directional movement of a financial asset over time. Here are some common trend trading strategies:

Breakout Trading

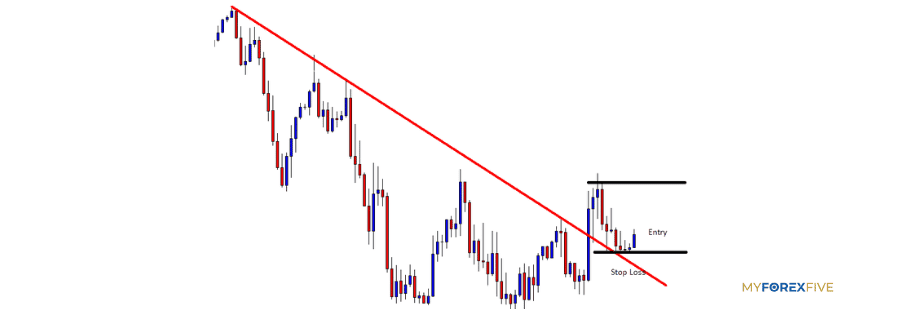

Breakout traders look for instance when the price breaks above a significant resistance level in an uptrend or below a significant support level in a downtrend. This breakout often signals the continuation of the trend, and traders may enter positions in the direction of the breakout.

Retracement Trading

This strategy involves entering trades in the direction of the trend during temporary pullbacks. Traders wait for the price to retrace against the trend to a key support or resistance level before entering positions.

Moving Average Crossover

This strategy involves using two moving averages of different time periods, such as a shorter-term moving average and a longer-term moving average. When a shorter-term moving average crosses above the longer-term moving average, it signals a potential uptrend, and vice versa for a downtrend. Traders may buy when the shorter-term average crosses above the longer-term average and sell when the opposite occur.

HOW DO YOU KNOW THAT TREND IS OVER?

Break of trendline

A break of a trendline that has been supporting or resisting the price movement can signal a potential trend reversal. For example, in an uptrend, a break below the trendline may indicate a shift to a downtrend.

Change in moving average

When short-term moving average cross below longer-term moving averages, it can signal a potential trend reversal. Example in an uptrend, a crossover of the 50-day moving average below the 200-day moving average may indicate a shift to a downtrend.

Price action trend reversal pattern

These patterns are based on the observation of price movements and the psychology of market participants. Example are head and shoulder, double tops or bottoms, and engulfing patterns.

Fundamental factors

Changes in fundamental factors such as economic data, geopolitical events, or central bank policies can also influence market sentiment and lead to trend reversals.

CONCLUSION

Trend trading offer traders with a systematic approach to capitalizing on the directional movements of financial assets over time. By identifying and following established trends, traders aim to capture profits as prices move in a consistent direction.

While no strategy guarantees success, incorporating trends trading technique into a well-rounded trading approach can enhance the probability of achieving profitable outcomes in a dynamic world of financial markets.