RISK MANAGEMENT

Risk Management is one of the most important topics you will ever read about trading, it is essentially a set of rules that are designed to minimize your losses and maintain a reasonable risk/reward ratio when placing trades. Also is one of the most important components of a trading plan and it can make the difference between gambling and trading.

Placing trades without consideration of the risks involved is gambling. On the other hand, trading is all about taking calculated risks - trying to minimize losses while maximizing profits. We are in the business of making money, and in order to make money, we have to learn how to manage risk (potential losses).

MOST COMMON RISKS IN TRADING THAT YOU NEED TO BE AWARE

Currency risk is the risk associated with the fluctuation of currency prices, making it more or less expensive to buy foreign assets

Interest rate risk is the risk related to the sudden increase or decrease of interest rates, which affects volatility. Interest rate changes affect FX prices because the level of spending and investment across an economy will increase or decrease, depending on the direction of the rate change

Liquidity risk is the risk that you can’t buy or sell an asset quickly enough to prevent a loss. Even though forex is a highly liquid market, there can be periods of illiquidity – depending on the currency and government policies around foreign exchange

Leverage risk is the risk of magnified losses when trading on margin. Because the initial outlay is smaller than the value of the FX trade, it’s easy to forget the amount of capital you are putting at risk

Social risk is connected to the social issues in a specific country. This includes the potential of social instability, political and economic issues, and social issues. Social risk can be mitigated by choosing a broker from a country whose reputation you are confident in and whose political and economic stability you are confident in.

WAYS TO MANAGE RISK IN FOREX TRADING

Only trade money you don’t need, the first rule in Forex trading, or any other kind of trading for that matter, is to only risk the money you can afford to lose. Many traders, especially beginners, skip this rule because they assume that it “won’t happen to them”

Money in a trading account should not be allocated for college tuition or the mortgage. Traders must never allow themselves to think they are simply borrowing money from other important obligations because trading with funds you live on will add extra pressure and emotional stress to your trading, compromising your decision-making abilities and increasing the chances of making mistakes.

Understand the forex market We cannot overstate the importance of educating yourself on the forex market. Take the time to study currency pairs and what affects them before risking your own capital; it’s an investment in time that could save you a good amount of money.

Build a good trading plan Creating a trading plan is a critical component of successful trading. It should include your profit goals, risk tolerance level, methodology and evaluation criteria. A trading plan can help make your FX trading easier by acting as your personal decision-making tool. It can also help you maintain discipline in the volatile forex market.

Think about your risk tolerance Before you start trading, you need to determine your risk tolerance, depending on knowledge of forex trading, your experience, investment goals and your age. Many beginners make the mistake of taking larger trades than they shouldn’t, which can really result in a big blow to the account if they incur a loss. You should only risk an amount that won’t evoke an emotional response from you in the event that you lose

Always use stop-loss and limit orders Forex market is particularly volatile, it is very important to decide on the entry and exit points of your trade before you open a position. Stop-loss orders are placed on an open position to get you out of a trade if the market moves against you, it ‘stops your losses and Limit orders will follow your profit target and close your position when the price hits your chosen level.

Understand and control leverage When you speculate on forex price movements with CFDs, you will be trading on leverage. This enables you to get full market exposure from a small initial deposit – known as margin. When using leverage, your profits can be magnified quickly, but remember the same applies to your losses in equal measure. This is why you need to understand how leverage and margin trading work, as well as how they impact your overall performance and trading.

Control your risk per trade and make it consistent, you also need to consider your risk per trade as a percentage of your trading capital and set it at a conservative level, this is especially important when you’re new to trading and are likely to make more mistakes than someone with experience. Just because you’ve made a few winning trades doesn’t mean the next one is going to be profitable.

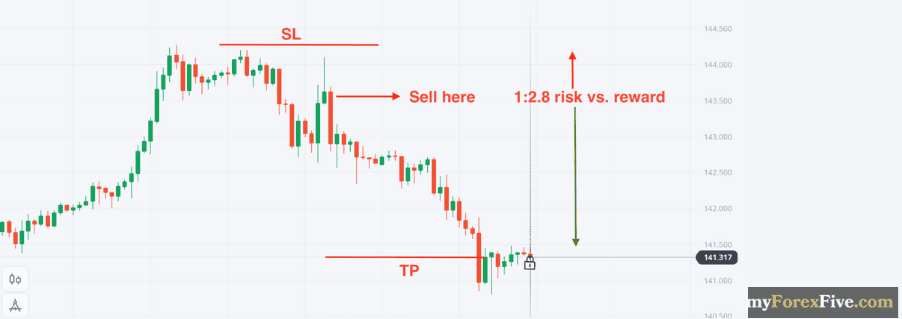

Set a risk-reward ratio It defines the expected income and losses in investments and trades. Traders use the R/R ratio to precisely define the amount of money they are willing to risk and wish to get in each trade. The risk/reward ratio is measured by dividing the distance from your entry point to Stop Loss and the distance from your entry point to Take Profit levels. Knowing about the risk/reward ratio (RRR) will definitely improve your chances of becoming profitable in the long run. Scalpers and day traders should aim to have a minimum RRR of 1:2, longer-term swing and position traders should aim for a wider minimum of 1:3 above.

Take currency correlations into consideration are a statistical measure of the extent that currency pairs are related in value and will move together. If two currency pairs go up at the same time, this represents a positive correlation, while if one fall and the other rise, this is a negative correlation.

Knowing about Forex correlations will help you better control your Forex portfolio’s exposure by reducing the overall risks.

Remember that forex trading involves inherent risks, and no risk management strategy can guarantee profits or protect against all losses. The goal of risk management is to create a structured and disciplined approach to trading that helps mitigate potential risks and preserve trading capital over the long term. Traders should continually refine and optimize their risk management practices based on experience and market conditions.