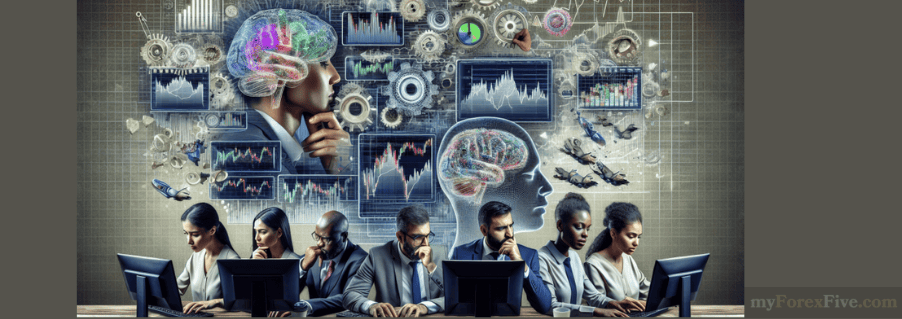

TRADING PSYCHOLOGY

Successful forex traders know how to manage and remove their emotions from trading. This outcome is achievable by overcoming greed, following risk management rules and employing a consistent trading plan.

Trading Psychology refers to the study and understanding of the psychological and emotional aspects that influence traders' decision-making, behavior, and performance in the financial markets. Having a proper attitude and developing a trader's psychology is essential for success in trading.

There are various psychological motives that affect the trader’s decisions. In fact, they are very subjective and individual traders experience different responses. However, trading psychologists still outline some of the more universal motives that tend to emerge all across the board.

- Fear

- Anger

- Impatient

- Greed

- Biases

- External pressures

Fear – Fear usually occurs after losing trades. Traders lose confidence in their trading system and are unable to place orders, even when great trading opportunities present themselves. Every trading strategy experiences drawdown periods, it's important to study whether the drawdown is temporary or the market conditions have changed and the strategy has become useless. To overcome fear after a series of losing trades professional traders decrease their position sizes or demo trade. Which helps them regain confidence in their system and simultaneously limit the drawdown amount.

Anger – Anger takes place after experiencing loses. Most unexperienced traders lose money because they are unable to take small losses. After loses, traders try to get back the lost amount quickly and open new positions without proper planning. "I'll close the position when I'm even" - you'll often hear such words from revenge traders. Revenge trading almost never ends well. Yes, you might win back the amount you've lost due to luck, but now you have learned very bad lesson and will try the same thing again in the future. Losing money and learning what not to do is better than making money and getting a bad lesson.

Impatience – Potential trade requires waiting for trading opportunities to come, planning and trading the plan. You can't force markets to give you trading opportunities. On many occasions, there are days without appearance of reasonable setups. When not in active positions, most traders think that they are wasting time. They feel bored and unproductive, which makes them open poorly planned orders and overtrade. Overtrading leads to destroying trading balance.

Greed – Greed also leads to overtrading as already mentioned, we all start trading because we want to make a lot of money. However, making money should be the least on your priorities list when trading. The number one priority is not losing money, the second one is trading the right way and the third one is making money. Greedy traders focus on money and ignore the other two. Greed makes traders overtrade or trade using large trading positions. It's obvious why overtrading is bad, it leads to trading poor setups. Trading using increased sizes is an equally bad idea. Consistently successful trading is dependent on probabilities. When trades become oversized, everything starts depending on single trades. Even when the setup has high success rate, there's always a chance of price going in the opposite direction.

Biases -- Biases are subconscious ways of thinking that can predispose traders to act in certain ways. We experience several biases in our everyday lives, but here are some that impact trading directly:

Negativity bias – is when an individual is more inclined to see the negative side of a situation (trade) and ignore the upside. This could lead a trader to completely overhaul their strategy rather than make minor adjustments

Hindsight bias – is the tendency for an individual to claim they ‘always knew’ the outcome would happen after the event has occurred. It can cause traders to misjudge their decision-making process and make them overconfident in their predictions

Gambler’s fallacy – is when an individual believes that an event is less likely or more likely to occur due to past events, even though the probability of it occurring has not changed. For example, a trader might assume a trade will earn a profit because the same position had been profitable in the past

Loss aversion – this is the tendency for individuals to place greater weight on their fear of loss over the pleasure they get from the equivalent win. So, a trader might want to avoid making a $200 loss, over making a $200 profit.

External pressure- Every trader experience external pressures as well as internal ones. The opinions, attitudes and behaviors of others can all have a direct impact on your bottom line. Herd behavior is the idea that individuals mimic the behaviors of the many. It can be dangerous if traders just jump into a trend without doing their due diligence and research, making decisions based on a fear of missing out on the profits they believe others are getting.

“The mind is a fascinating instrument that can make or break you.”

― yvan Byeajee,

COMMON PSYCHOLOGICAL TRADING MISTAKE

REVENGE TRADE Trader after facing a loss, will have the urge to enter a trade with the same or different instrument in the hope of making a lot of money or making back the money they lost. Trading on emotion rather than strategy and discipline, the more you try to claw your way back into the market, the more it will take from you. What could have been a one-time loss eventually becomes a drastically depleted trading account or the dreaded margin call. You just can’t beat the market so do not argue with the market. If you lost your money then keep patience and wait for the best opportunity. It’s critical to have the self-control and follow your trading plan to avoid this situation.

EXPECTING TO MAKE PROFIT FROM EVERY SINGLE TRADE OR DAY

You can aim for a weekly or monthly income overall, but hoping to make something every day will throw you into a downwards spiral. It does not happen for anyone this way. So, don’t keep such expectations from yourself.

FOMO TRADING It is called fear of missing out, which means you are chasing a trade influenced by your emotion. You always feel fear because of asset price movement. It can cause you to take every single trade you see at a higher price or you make oversize your position size. The whole problem with FOMO is the thinking that this one is it and that you will not get a chance like this again. You will. It might want to go for a bigger lot size than you usually go for and can afford. Also, it might want you to take every other trade. You have to be wise when picking your positions. Even if you miss some, that’s fine.

DESIRE FOR OVERNIGHT SUCCESS A lot of traders when they’re starting out expect to be the exception to the rule- the rule that says that not all trades are going to be profitable and you will not become an overnight millionaire.

Don’t underestimate the process. Trading, when it’s sustainable and profitable for a long period of time, is a slow grind. Even the traders who are very successful face losses and there is a 100% chance that you will too.

HOLDING A LOSING TRADE FOR HOPE The majority of traders hold their losing trade and cut their winning trade. If you are also in this category, then this is the worst trading mistake ever. Don’t get influenced by your own emotion, it ruins your trading career. Many traders hold their losing trade because they believe this trade will go in their favor but it happens wrong.

DEPENDING ON OTHER’S KNOWLEDGE AND ANALYSIS Sure you can use them, but make a strategy of your own- one that is informed by your own reading and research. Don’t just keep acting on what you hear from others. It’s helpful to take good advice, but take it with a pinch of salt and develop enough understanding of the system to figure out what will work for you and what won’t.

CALCULATING PROFIT BEFORE EVEN EXECUTING THE TRADE

This is specific to new traders. The kind of thinking that says ‘if I enter such a trade and make such and such profits on the first one and this much on the second one’ is very harmful. This is because ‘such and such’ will probably not happen. The market is unpredictable and losses are inevitable. So don’t go in with high expectations to the point that you get disappointed and lose faith in your trading skills when you’re not able to reach that profit.

HOW TO IMPROVE YOUR TRADING PSYCHOLOGY

It is not about getting rid of your emotions, but rather about understanding and controlling them. To achieve this, a trader must:

Set rules You need to make your own rules for trading and follow them. Most trading plans involve setting a risk tolerance level that tells you when to trade and when to close out. This can include where you’ll enter stops and limits to automate these decisions

Have a solid trading plan You need to have a clearly defined plan - which system you will use (whether it is fundamental analysis, technical analysis, or a mix of both), its advantages and disadvantages, how you will identify trades, and how you will manage them. This needs to be accompanied by a trading journal, where you can write down your observations, identify your weaknesses, and build on your strengths which can help you avoid common trading mistakes and become a profitable trader. Jumping from strategy to strategy will do no good and emotional trading will take over.

Assess your performance Every few weeks, you should take the time to look back at your trading outcomes, your positions and how you’re progressing. This can help you identify and change any bad habits that you’ve picked up.

Understand their risk appetite Some traders might be comfortable taking larger risks and manage to keep a cool head even if they are facing a not-so-small drawdown. However, if you are just starting or generally have a lower risk appetite, this is unlikely to end well. You first need to identify your own risk appetite and plan accordingly.

Do your research Never make assumptions about how a market will move. And even though analysts and other news sources are a great place to start, it’s important to do your due diligence before you open a position

Know when to take a break If you feel stressed and exhausted, you are more likely to make mistakes or engage in revenge trading. It could be a good idea to set a rule for yourself that will define after how many consecutive losing trades you will take a break and stop trading until you have reviewed what happened.

Protect what you have the first priority is not to blow up your trading account. The second priority is to trade the correct way. The third priority is to make money. Remember, consistency in trading is highly rewarded by the investors.

Don’t expect fortune right away success doesn’t always come knocking on your door right after you’ve started trading. In fact, your individual positions will likely generate smaller payouts. But that shouldn’t upset you because that is how it usually happens in trading anyway. Successful traders stick to a plan and take things one step at a time, which ultimately results in a successful trading career

Discover your personality when deciding to trade on a financial market, it can be of massive help to find out your personality trait: whether you’re an impulsive person or someone who doesn’t fall for emotions that easily. If you find out that you’re an impulsive trader who can be overcome with fear or greed, knowing it beforehand will help you control the emotions more effectively.